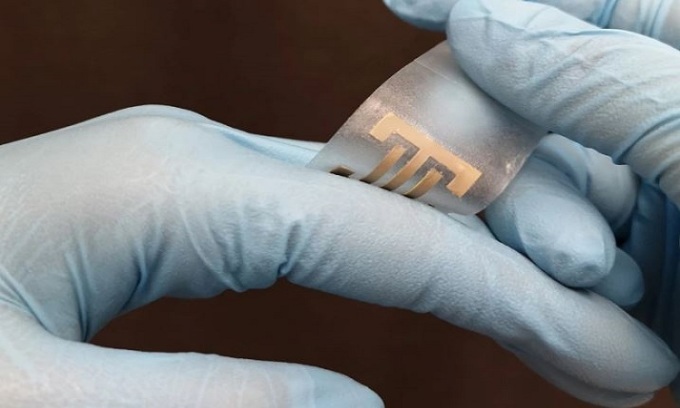

Semiconductor technology has been at the headlines of many coverages, especially after the US government passed CHIPS & Science Act bill earlier this month.

In the latest effort to consolidate its position as a world leader in chip technology, Samsung Electronics (Korea) on August 19 kicked off the construction of a semiconductor research and development (R&D) complex in the South of Seoul.

The Korean tech giant intends to invest about 20 trillion won ($15.06 billion) by 2028 to build a 109,000-square-meter complex in the Giheung district, Yongin city. This advanced facility is expected to help Samsung lead the way in the areas of advanced semiconductor systems and chips research.

The ceremony for the new center witnessed the attendance of about 100 Samsung executives and employees, including Samsung Electronics Vice Chairman Jay Y. Lee, President and CEO Kye Hyun Kyung, President of the Memory Business Jung-Bae Lee, President of the Foundry Business Siyoung Choi, and President of the S.LSI Business Yong-In Park, among others.

Samsung said it plans to strengthen cooperation with domestic and foreign partners in the field of materials, equipment, and spare parts through the construction of an R&D complex.

In July, Yonhap reported that Samsung Electronics is planning to invest nearly $200 billion to build 11 more semiconductor factories in the United States over the next two decades.

Specifically, this investment was sent by Samsung to the Texas government to seek tax breaks for the construction of 11 new chip manufacturing facilities in the state, including 9 factories in the city of Taylor and 2 factories in the city of Austin.

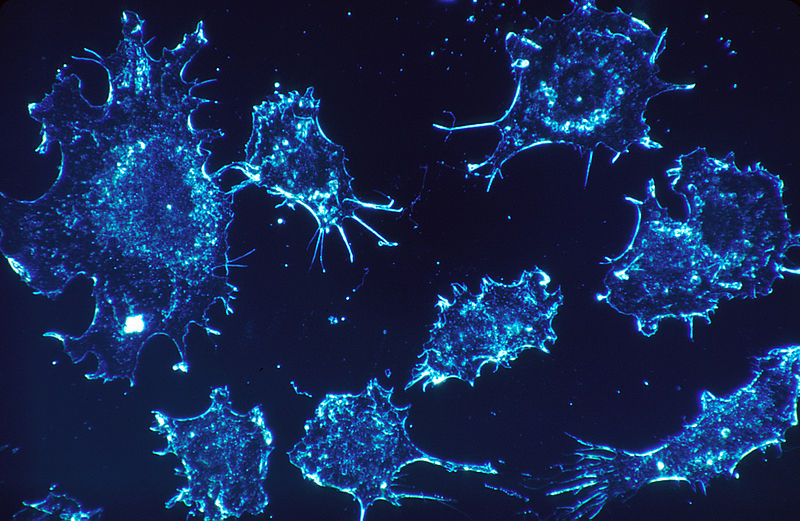

Samsung is gearing up for the semiconductor race, which is now led by the Taiwanese group TSMC. TSMC holds the lion’s share of the semiconductor market. With the increased production rates of the company’s subsidiaries and the quality standards in its processes, TSMC is an almost irresistible force.

Samsung is the main component of TSMC. However, Samsung is lagging behind TSMC in terms of market share. While TSMC supplies 92% of the global market, Samsung is only responsible for the remaining 8%.

The new investment promises billions of dollars in capital, allowing Samsung to maintain its competitive advantage while leveraging its world-class business environment and diverse, highly skilled workforce.