Insurance is both a backup and, most importantly, your first line of defense when something goes wrong. The last thing you want when a lawsuit, natural disaster, or theft comes your way is to have to bear the brunt of the cost yourself. Doing that can bankrupt your business outright and kill it, no matter how well you were doing beforehand. This is why it’s essential that you have adequate coverage for your company, even if it’s not legally mandatory.

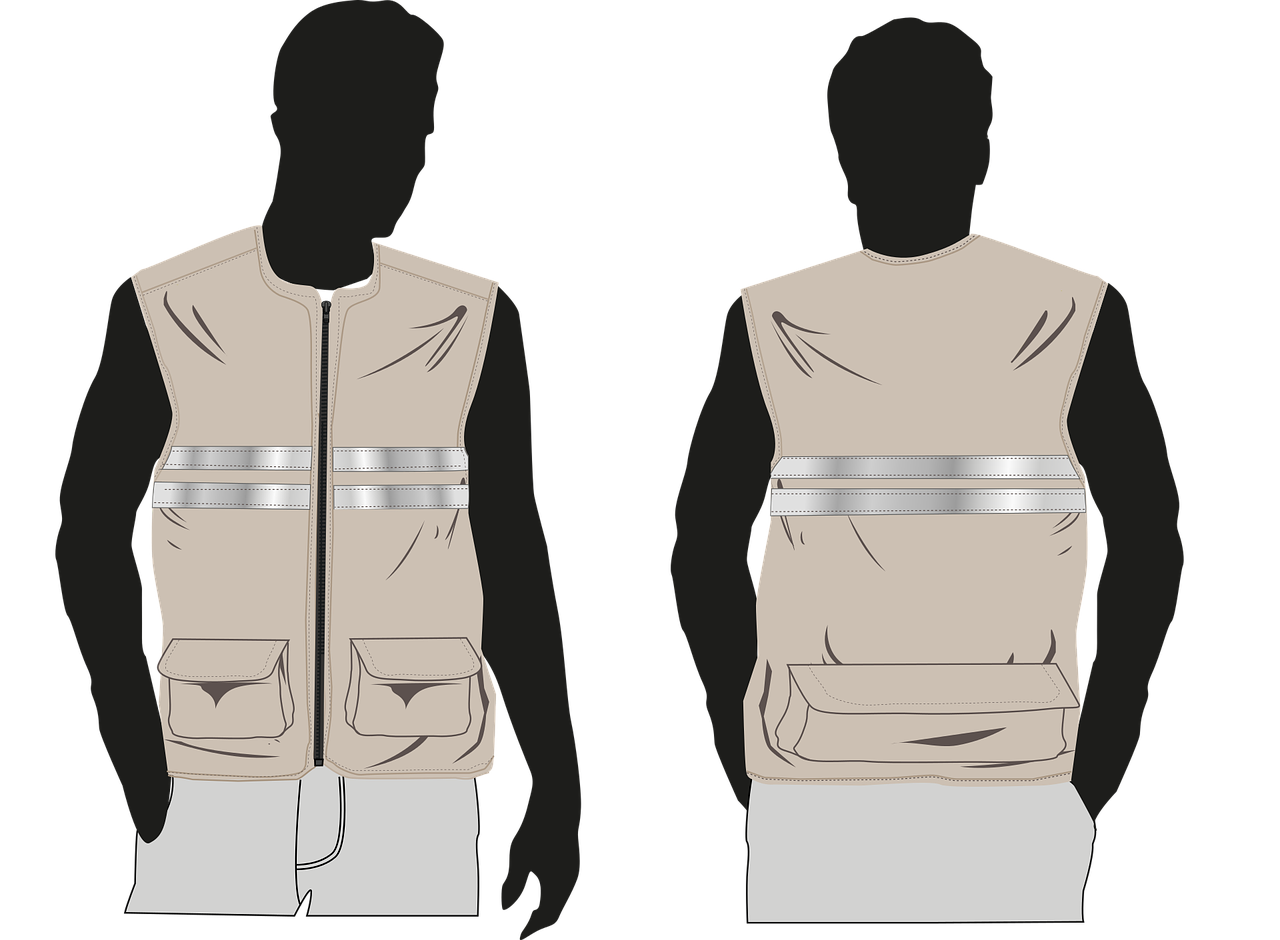

Manufacturing companies need to be covered for a whole host of areas — worker’s compensation, equipment, cyber, and liability. General or professional liability is a must, yes, but know as a manufacturing company you’ll also want product liability insurance to help manage your most pressing risks.

What is Product Liability Insurance?

Product liability insurance is a special subset of liability insurance that’s of particular interest to production and manufacturing companies. Your business model, after all, involves the production of items. It is, therefore, your responsibility that the products are made to spec. If you work with other businesses, then you only need to make sure your products are made according to their blueprint. If you design the products as well, you will need to undergo vigorous testing to ensure the health and safety of your products. Even with that, however, mistakes are made. Issues come up in unexpected places.

Is Product Liability Included in General Liability?

No, product liability isn’t usually included in general liability since most industries and businesses just don’t need it. If yours does, then you’ll want to either tack on product liability or find a bundled solution through an insurance broker like kbdinsurance.com. This type of insurance can protect you from unexpected issues. So long as there isn’t any sort of criminal negligence involved, you’ll be able to weather the financial impact that a huge recall can cause.

What Are Your Responsibilities if You Send Out a Faulty Product?

If you do become aware of an issue with a product, it’s your responsibility to recall the product and notify customers through a series of campaigns either directly through email or mail or indirectly through your business clients (like a grocery store). As part of this recall, you’ll need to provide a remedy. This can be a refund or a replacement. For small items like a batch of products that were improperly sealed because your machine broke, this is a very straightforward process. For more serious faults, like a defective component in a car, it can be a huge undertaking.

Remember, in some cases, you’ll also need to report the issue to a governing body. Having someone on board, either in-house or whom you can call in as a consultant that specializes in this area of the law, is going to be a huge help. Only when you do everything right can you get maximum coverage from your insurance. Not only that but you can be fined and even face criminal prosecution if you try to hide issues, especially if those issues negatively impact the health and safety of your customers.