In a statement, the Chinese government announced that it would restrict exports of some key components in making semiconductors to the U.S. Some of the materials banned are metals gallium, antimony, and germanium. In addition, exports of graphite, another key component, will also be subject to stricter reviews.

Gallium and germanium are used in semiconductors while Antimony is used in bullets and other weaponry. Not only that, its curbs also restrict the exports of items used for United States military users or military purposes.

This move is considered a retaliatory strike at the U.S. after the North American country announced restrictions on sales, without additional permission, to 140 companies including Chinese chip firms Piotech and SiCarrier.

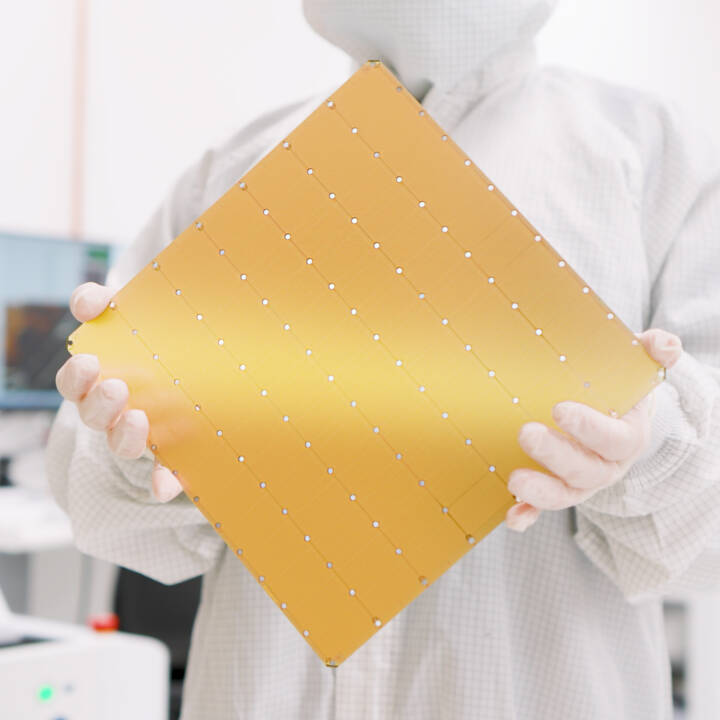

Washington’s effort is to curb exports of state-of-the-art chips to China, which can be used in advanced weapons systems and artificial intelligence. The new rule of the U.S. also includes controls on 24 types of chip-making equipment and 3 kinds of software tools for producing semiconductors.

According to a report by the European Union published this year, China accounts for 94% of the world’s production of gallium, which is used in integrated circuits, LEDs, and photovoltaic panels. For germanium, a key element for fiber optics and infrared, China makes up 83% of production.

Last year, China had already tightened restrictions on exporters of the metals by requiring them to provide information on the final recipient and give details about their end-use. However, the newest curbs now ban them outright.

Previously, Beijing also restricted curbs on exports of certain types of graphite, which is the largest component of making batteries for electric vehicles.

According to Chinese customs data, there were no shipments of wrought and unwrought germanium or gallium to the US this year through October despite it being the fourth and fifth-largest market of China for the minerals last year.

Additionally, China’s overall October shipments of antimony products dropped by 97% from September after Beijing’s move to limit its exports took effect.

There is a concern that China could next target other critical minerals with wide usage such as nickel and cobalt. However, many intermediary manufacturers in the supply chain have been stockpiling these materials as the US-China trade tensions have persisted for some time.